Metizsoft Solutions is a leading name in the industry for building high-end next-generation apps that simplify users’ lives with the great features of the app. The company has created magic in the form of top-notch websites and apps since its inception. We believe in delivering valuable apps with outstanding performance and user experience with the right strategies and updated technologies. We have consistently delivered quality services and have been a part of the client’s success story.

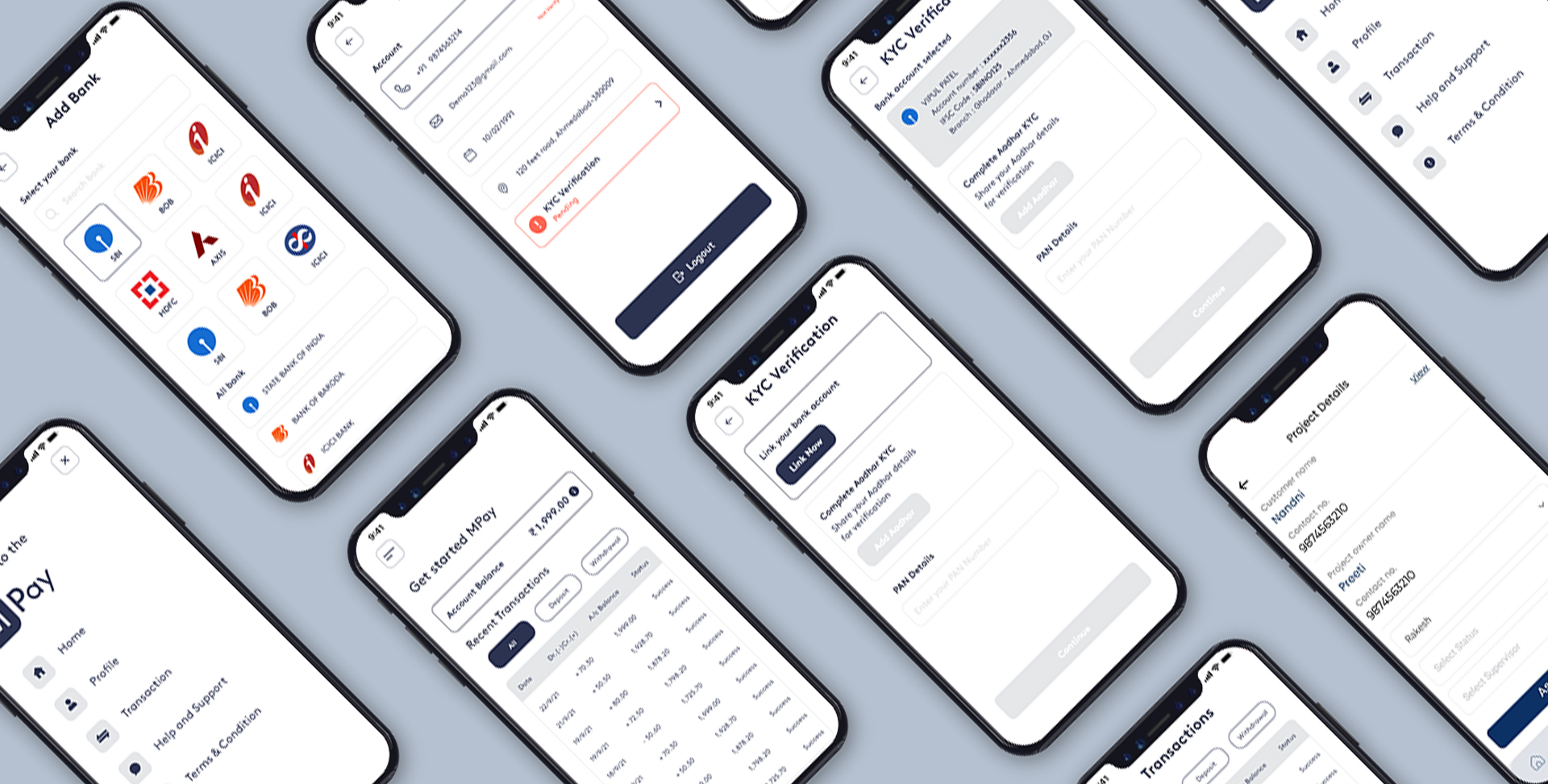

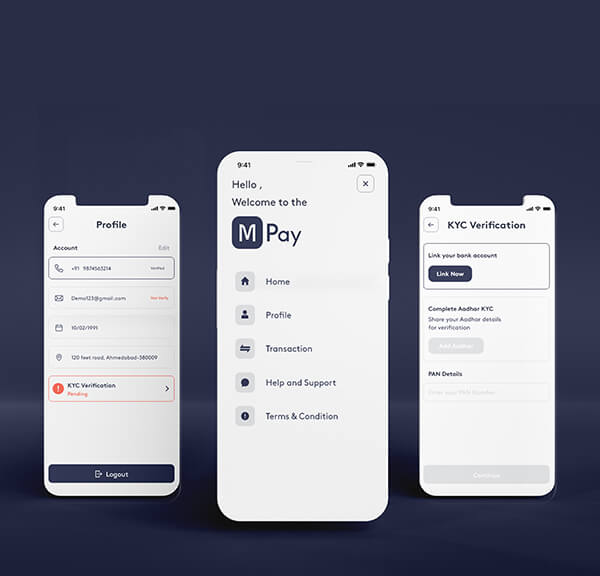

Our client approached our team with an idea of a KYC app where the customers can get their KYC done with a few documents and minimum processing.

Our client had an idea of how they want the app to be, and they wanted the app to be easy to use

and understand. The client also wanted a simple user interface for the app.

As per our first discussion, we understood the client’s idea, but we knew the client didn’t have much clarity about the app’s features and functionality. We, however, understood the idea and decided to go ahead to shape that idea into reality.

Metizsoft Solutions and its team has successfully worked on several apps in the past, and it always excited our team to work on something new, something creative. With a positive mindset, we got to work to create a great app with great features.

As a renowned app development company, our mission was to put our resources to the most productive use and have an agile approach towards building something unique.